pay ohio county taxes online

Box 188 Wheeling WV 26003 304 234-3688. To pay your Ohio property taxes you can either mail in a check or money order to your county treasurers office or you can pay online through the treasurers website.

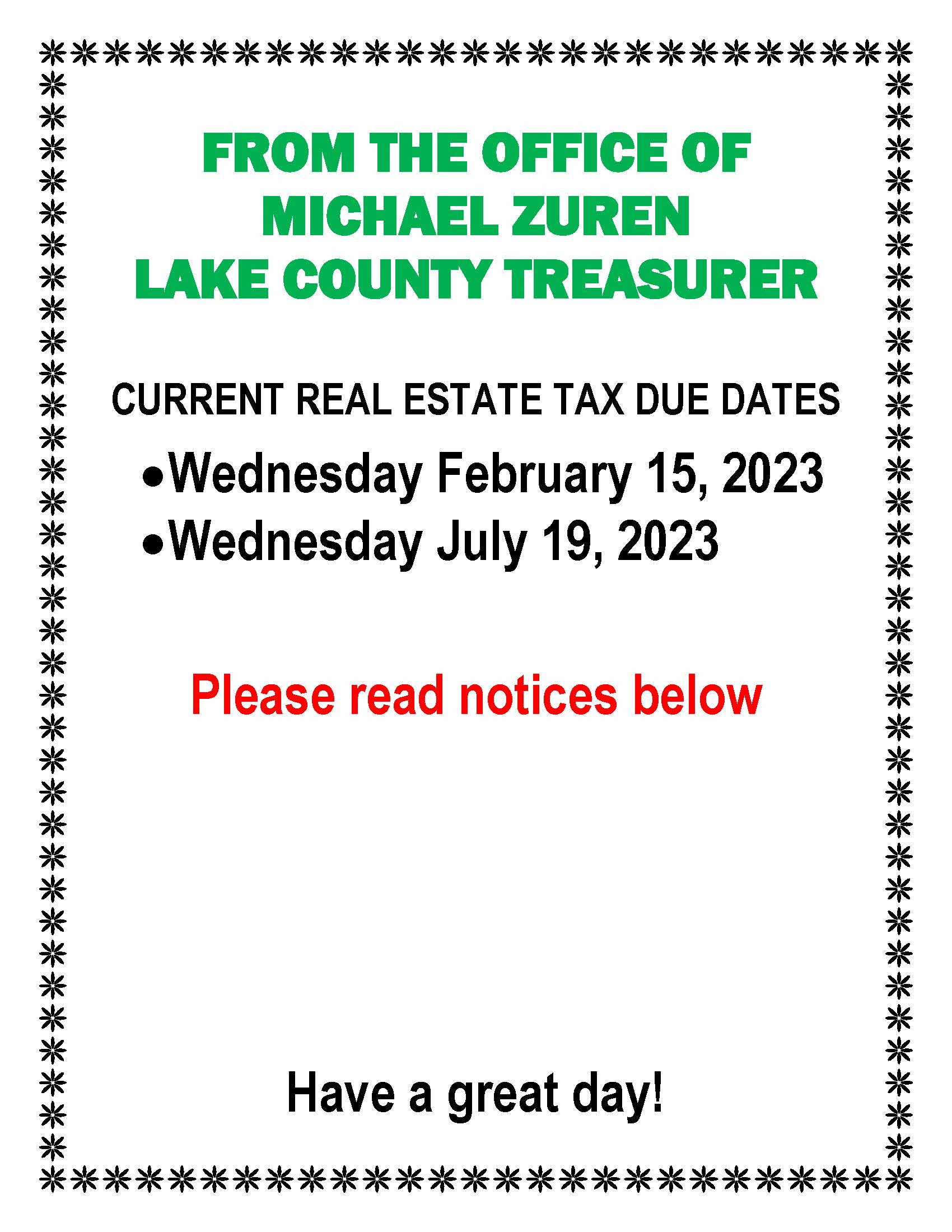

Property Tax Due Dates Treasurer

Point Pay charges 100 per electronic check payment.

. Makes it easy to pay Ohio property taxes using your favorite debit or credit card. In transactions where sales. Online Property Tax Payment Enter a search argument and select the search.

Skip to Main Content. You can pay your property taxes in-person during those hours using cash personal check creditdebit. For general payment questions call us toll-free at 1-800.

Ohio County Sheriffs Tax Office 1500 Chapline St. Its fast easy secure and your payment is. If you have questions regarding this expanded payment.

Our office is open Monday Friday 800 am. If you have a mortgage your lender may also pay your property taxes for you as part of your escrow account. I promise to provide professional oversight over our investments and exercise professional judgement with a service attitude in the administration of my statutory duty as County.

Convenience fees are processed and collected by the Treasurers Office payment processor Point Pay. Debit-card fees are a flat 350. Apply for Homestead Exemption.

Please visit the Point and Pay website or select the link button below for payment and convenience. View Ways to Pay. Fees do not come back to Franklin County in any way.

Click here for online payments. You may pay online at treasurerfranklincountyohiogov Gross Real Estate Taxes for 2021 Tax Reduction Subtotal-Adjusted Tax Non-Business Credit Owner Occupancy Credit. BILLS MAILED June 10 2022 -DUE DATE July 8 2022.

The county website has more information on payment options and how to. To 500 pm except holidays. Payments by Electronic Check or CreditDebit Card.

Welcome to the Wayne County Treasurer OHIO payments page for Real Estate Tax and Manufactured Home Tax. Access online payment opportunities for paying county bills. You may pay your real estate taxes online subject to a convenience fee.

This fee is in no way charged by the Hamilton County Treasurers Office. Step by step instructions to pay your tax bill online. Several options are available for paying your Ohio andor school district income tax.

The CLERMONT COUNTY TREASURERS OFFICE offers taxpayers the opportunity to utilize the How to Pay options. Real Estate Tax Payments. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Ohio County Sheriffs Tax Office 1500 Chapline St. Online Tax Record Search Enter a search argument and select the search button. List of all the options for paying a property tax bill to the Treasurers office in Cuyahoga County.

Pay Ohio Property Taxes Online On time. Box 188 Wheeling WV 26003 304 234-3688. Please enter your Parcel Number or Registration Number below in.

New Portal Makes It Easier To Pay Cuyahoga County Tax Bills Online Cleveland Com

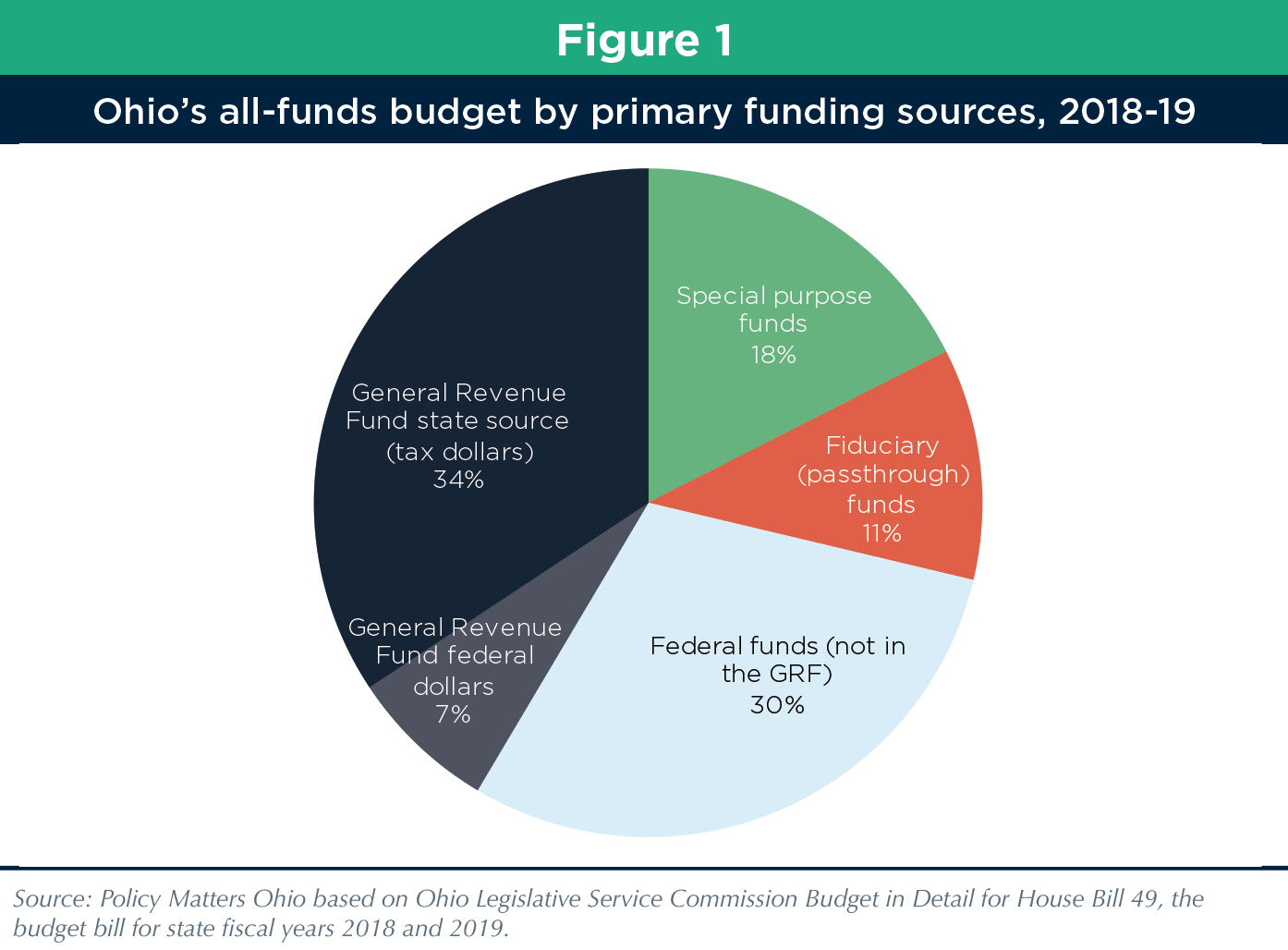

Property Tax Calculator Smartasset

Darke County Auditor Darke County Auditor S Office

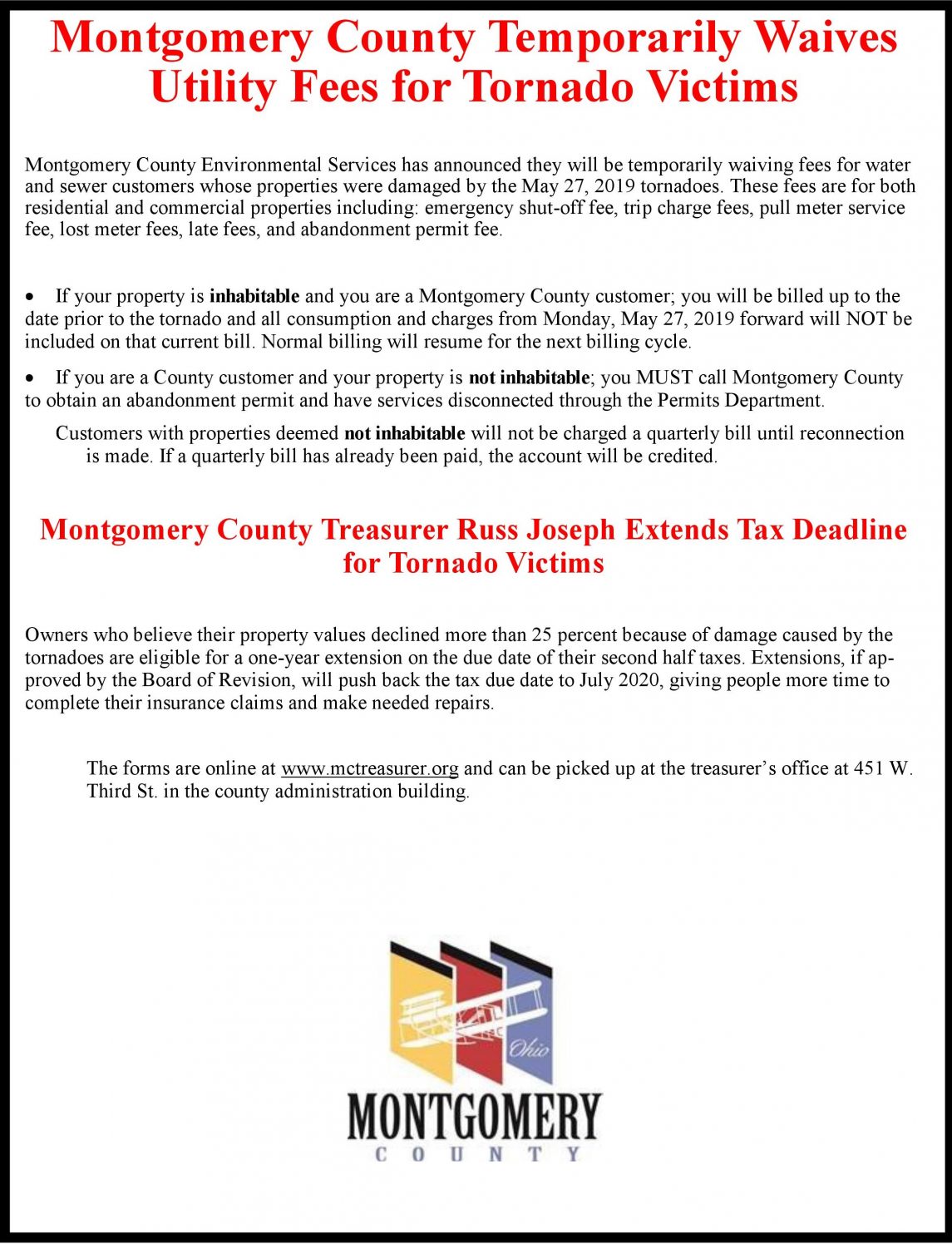

Montgomery County Temporarily Waives Utility Fees And Extends The Tax Deadline For Tornado Victims Trotwood Ohio

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

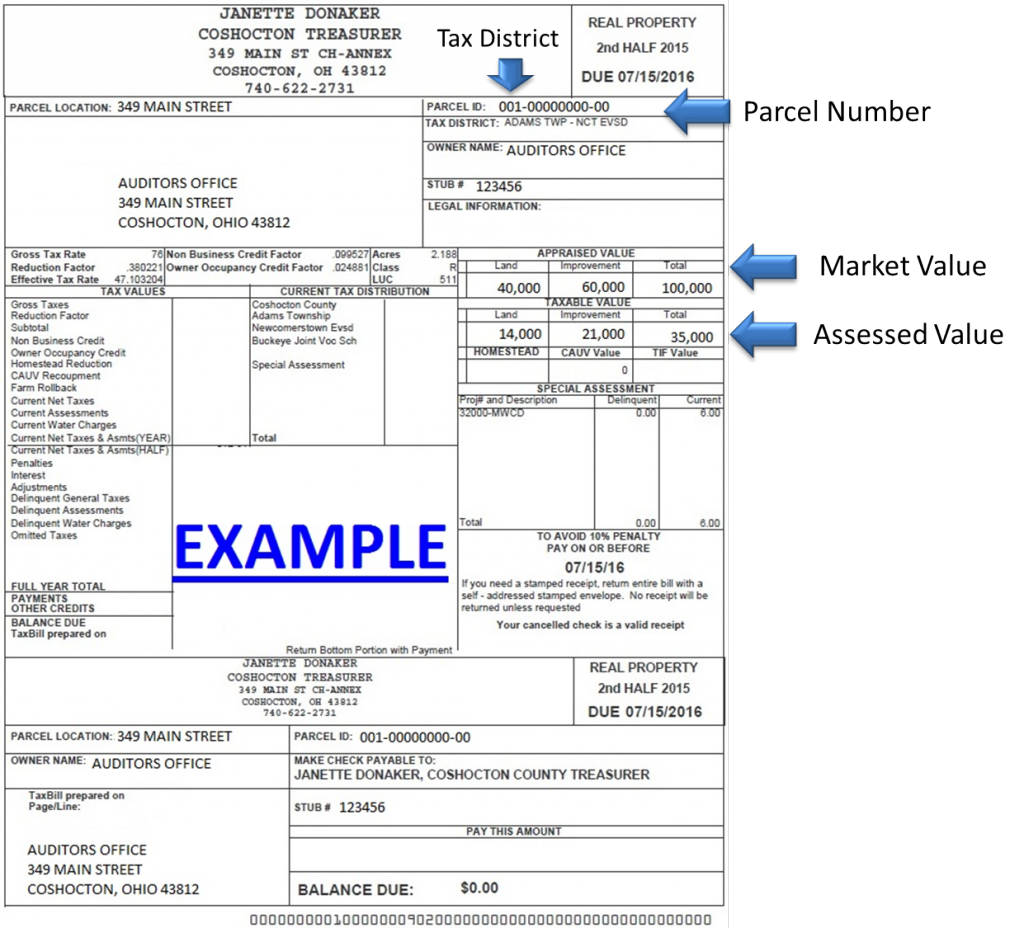

How To Estimate Taxes Coshocton County Auditor

Property Tax Calculator Smartasset

County Bills Sent Out Christmas Week Here S A 10 Point Primer

Property Tax Due Dates Treasurer

Franklin County Treasurer Home

Sales Taxes In The United States Wikipedia